Individual fund is approximately how you oversee your cash and incorporates all perspectives of money related choice making. Learning viable budgetary aptitudes is the key to a sound way of life that gives security and dispenses with the stretch that comes with budgetary worries.

Improve your understanding of distinctive zones of Individual fund, counting budgeting, obligation administration, sparing and, in a few cases, contributing will offer assistance you succeed in your every day life and bring clarity to each monetary choice, enormous or small.

If you need money related opportunity, your individual accounts play a vital part in guaranteeing that all viewpoints of your wage are well overseen, that you do not overspend and that you can make installments without running out of cash. some time recently payday.

Find out how to improve your financial skills by following these important rules:

1 Don't spend more than you earn

When your bank balance seems healthy after payday, it's easy to overspend and not pay as much attention. However, there are several problems that push people to borrow money, accumulate debt, and live beyond their means. Here are some reasons:

Follow in your parents' footsteps: You learn a lot from them, including how they spend their income. If your parents spend recklessly, you probably follow this view too.

Lack of budget: The importance of a budget can be greatly underestimated, but having a plan How to split your income and profits is key to tracking expenses and avoiding future cash flow problems, but we'll talk more about budgeting later.

Don't prepare: Prepare to fail: Sure, living day by day is a good mantra, but not when it comes to making financial decisions, especially expensive ones. Preparation is key to making sure you don't overdo it and run out of money, and to make sure you're covered for whatever tomorrow brings.

The problem with spending more than you earn is the unpleasant side effects that can occur. If you put an end to your debt lifestyle, the situation can easily spiral out of control and cause you to make even more payments with no end in sight.

Yes, if ' If you're tempted to make a purchase you're not sure you can afford, check out our blog post with some questions you should ask before taking on new debt.

2. Get out of the debt spiral and stay out of it

According to the Financial Advice Service, 8.3 million people in the UK I am over-indebted, made worse by the coronavirus pandemic.

If you're struggling to get out of debt, there are free services like Step Change that can help you plan your money. Request debt relief (if applicable) and suggest changes that will get you back on the path to financial well-being.

Here are two different approaches people have taken to reducing their debt.

The snowball method

This involves making the minimum payment on all your debts and then paying the most small debt. First of all. one after the other. This method promotes motivation because you get paid much faster.

The Avalanche Method

Again, it's about doing it every time to have success . minimum payments. your debts, but then you will pay more for the debts with the highest interest rate. So, if you had £1,000 on a credit card with a 29% interest rate, or a £15,000 car loan with a 3% interest rate, you'd pay off the credit card first.

For more information on how to get out of debt, check out our blog post “8 Secrets to Managing Debt on a Budget.” Here you will find some practical steps to recover. Check your finances.

Once you get out of the debt cycle, it is much easier to never get back into that situation. Because to experience the financial freedom of a debt-free life, it pays to make more than the minimum payment on all your debts.

3. Building an emergency fund is a must!

In 2020, the Money Advice Service revealed that 22% of UK adults had less than £100 of savings, potentially making them vulnerable to the impact of significant changes in their income, such as job loss or unexpected costs.

This is where the problem comes in : Have an emergency fund to avoid problems when your finances take a hit. You should save three to four times your monthly salary to cover major expenses or changes in income.

To help you get started, we've written a helpful blog post with simple steps to help you create a successful emergency fund.

4. Get your budget in order

Creating a spending plan for your money ensures you can always pay for needs essentials and things that are important to you. A budget will help you avoid accumulating debt, find areas to save money, and take back control.

Here are some simple steps to help you get started (or improve ) your budget:

Write down your income and all your expenses; This can include rent, utilities, groceries, child care, and gym memberships. and travel expenses.

Calculate the difference and see exactly how much you have left to spend.

Determine how much you want to set aside for luxuries like eating out or travel. vacation. and clothes and how much you can actually save.

Get into the habit of reviewing your budget every two weeks to make any necessary changes or improvements.

Learn how to create an effective budget with our helpful tips when you are eligible for the universal credit. . and tips.

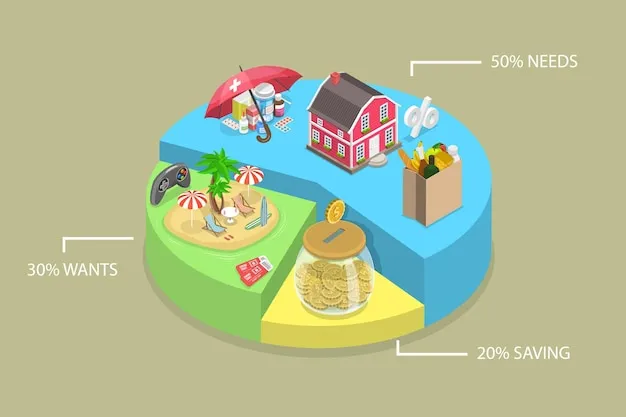

5. The 70:20:10 budget rule

After you create a budget, rule 70 applies: 20. applies: 10 The budget rule is a simple principle you can follow to determine how much of your income you can reasonably spend, save, and use to pay off debt, regardless of your income or debt level. Here's how it works:

First divide your net salary and divide it by 70%, 20% and 10%:

70% is all your monthly expenses, including all bills, meals and travel expenses.

20% of your income It should go into your savings unless you have urgent debts to pay. These should come first if the bottom 10% don't cover all their payments.

10% is used to pay off any debt payments, starting with the highest priority.

Of course, this rule can be changed to become. Therefore, if you want to pay off more debt or save more, you will need to adjust the categories accordingly to round to 100%. However, remember that budgeting is about finding a solution that works for you and helps you achieve financial well-being.

6. Always do your research before getting a quote. decision. purchase

If you wish to make any type of purchase. Don't forget to check online to see if you can find something cheaper elsewhere.

According to a Think with Google study, 53% of shoppers say they buy . before purchasing. . shop to ensure you make the best decision possible, but there are still ways to improve your search to ensure you save more money.

One way to do this is to add a coupon finder like Honey to your browser extension that will help you find discounts, coupons, promo codes and offers while shopping online and automatically add them to your cart.

Another way to save, especially when purchasing on a new website, is to sign up for the newsletter. Some companies offer a 10% discount on your first purchase. If you are a student or NHS worker, many companies offer a 10-25% discount on your purchases.

Additionally, Suits Me® account holders can save money by simply using their Suits Me® debit card to repay our retail partners. Learn more about our unique cash back program so you know where to start saving!

7. Separate your feelings from your finances

Do you realize that when you feel like you need something to cheer you up, you spend money to increase your happiness? You're not alone.

Sure, it's not that bad to treat yourself every now and then, but compulsively spending money to fill a void is something you can get into serious trouble financial, aggravated by the consumer society in which we live.

The first step to solving this problem is to recognize the signs, become aware of your consumption habits, when you are more likely to make an unnecessary purchase and what you try.

8. Maintain or work to improve your credit score

Your credit score shows lenders how likely you are to you repay the money they own and are welcome to borrow. Your credit score also determines the interest rates you are eligible for. The better your credit score, the more likely you are to get a loan on the best terms.

A good credit score is crucial when applying for a loan. I would like to need a credit card, buy a new car with financing, or need a mortgage to buy a house. It takes time to build your credit score and make improvements. Therefore, it is worth starting early to plan the future financial goals you want to achieve.

To learn If you would like to learn more about how to achieve your goals, improve your your credit history, we've written a helpful blog post that explains some of the reasons for a low credit score and some simple ideas for improving it.

9. Follow a nutrition plan to maximize savings

One of the best ways to avoid unnecessary expenses is to reduce your food expenses. , some of these activities may seem boring, but when you find a routine that works for you, you can reduce unnecessary spending and unnecessary food waste.

Just in the UK, the average Brit spends £451 a year on around 34 takeaways, a number that rises every year, according to a survey by accountancy firm KMPG.

A meal plan can be a useful tool to help you know exactly what ingredients you need throughout the week, to avoid unnecessary purchases, and to avoid ordering that pizza when you're simply low on food. .

Are you hungry? Before you head to the store, read our blog post on 5 Ways to Save Money on Groceries to Lower Your Grocery Bill.

Can a prepaid card help you improve your personal finances?

A prepaid card works the same way as a credit debit card unless there is no overdraft. or a line of credit is connected to it, which eliminates the possibility of getting into debt and having to pay commissions and expenses for the loan.