Investors, are you prepared for next year? When investing for the long term, you may be tempted to “set and forget” your portfolio, but by doing so you risk missing out on good opportunities to add to your portfolio for next year.

If you don't take the right steps to monitor your portfolio, you also run the risk of making hasty and ill-informed decisions that are not aligned with your investment strategy and do not benefit your long-term performance.

If you're looking for simple ways to improve your performance and strengthen your portfolio against market volatility, here are four ways Share sight can help you become a more prepared investor.

1. Evaluate Your Investment Strategy With Powerful Reporting Tools

Maybe it's the beginning of the year and you want to update your strategy every year, or maybe. We're halfway through the year and you want to rebalance your portfolio due to changing market conditions. In any case, it is important to first have an overview of the asset allocation and diversification of your portfolio.

To determine the asset allocation, you can run the Share sight report - Diversity report (available on Investor and Specialist plans) showing how your portfolio is diversified across different investment types, markets, countries, industries and sectors. You also have the option to create your own custom groups that reflect your specific investment strategy or asset allocation goal.

Read Also: Investment Terms Every Investor Should Know

Once you have determined your asset allocation, you can run the Contribution Analysis Report (available on the Investor and Expert plans) to see how your asset classes are performing compared to others.

This can be done over a period of your choosing and is a good way to evaluate the success of your investment strategy and see if you need to rebalance your portfolio.

Yes If you are an ETF investor, the Share sight Exposure Report (also available on the Investor and Expert plans) is another useful tool for rebalancing your portfolio.

The report shows your portfolio's exposure to different industries, asset types, and sectors by listing your direct stock holdings and shares held in exchange-traded funds (ETFs). This allows you to clearly identify any overlaps in your portfolio and facilitate diversification by eliminating unnecessary stocks or ETFs.

2. Track Your Portfolio Against A Benchmark

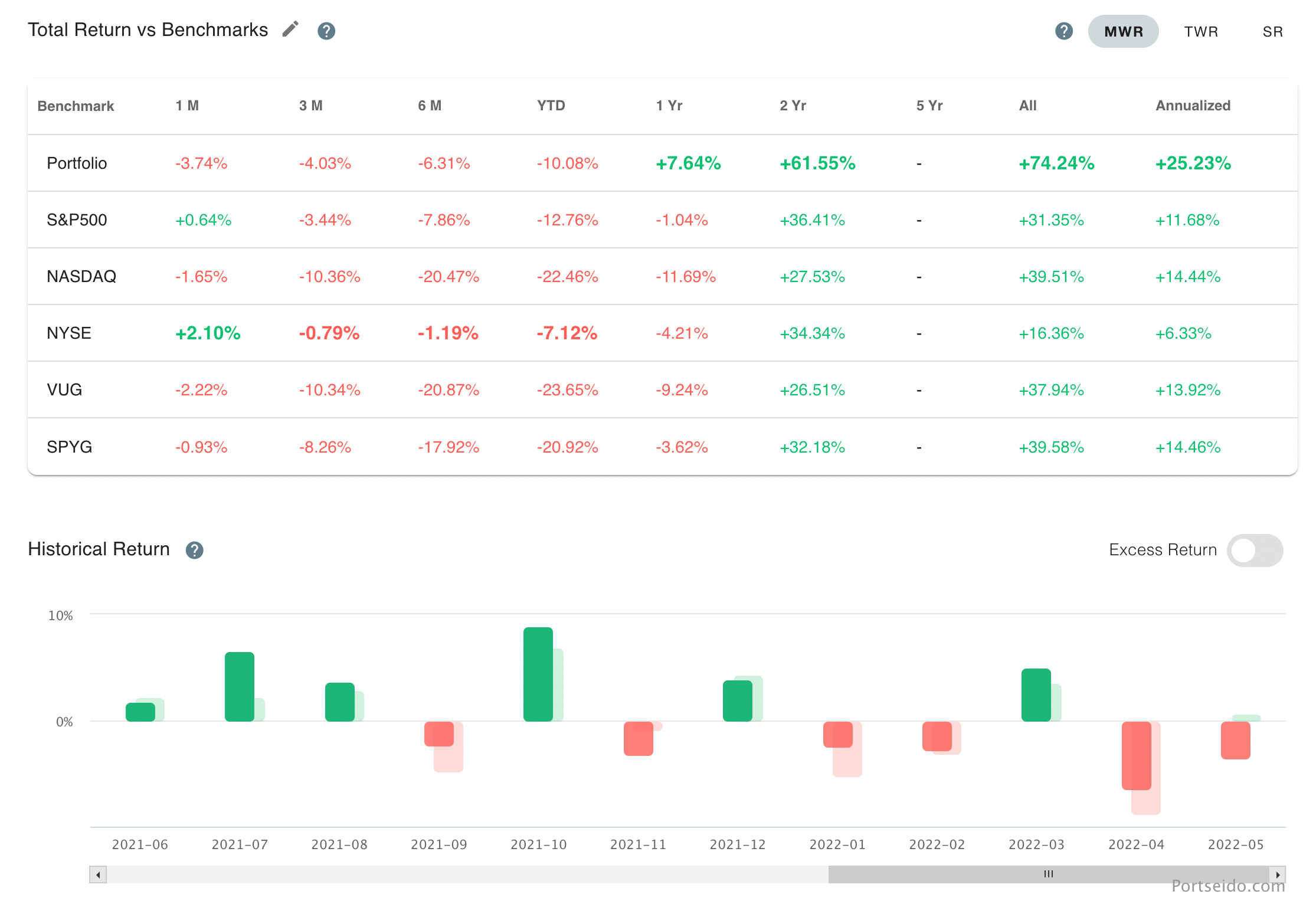

After evaluating your investment strategy and rebalancing your portfolio if necessary, now is the right time to start tracking your wallet. Using a reference point.

For example, by comparing your portfolio to an ETF that tracks an index, you can monitor your portfolio against market trends. This allows you to determine whether your portfolio's performance is due to market conditions or your investment decisions.

Investors can compare their portfolio to one of over 500,000 wallets. . Stocks, ETFs, funds and mutual funds guaranteed by Share sight. Simply click "Add Benchmark" on the portfolio overview page and select the instrument that best reflects your asset allocation or investment strategy.

As shown in the screenshot below, Share sight makes it easy to compare your portfolio to the benchmark. In this case you could, for example, decide to change your investment strategy or even invest your money in the reference ETF instead of continuing to select shares.

3. Control And Track Your Dividends And Distributions

When investing in dividend-paying stocks, it is important to have a way to view all dividend declarations. Or to keep an eye on. You can track them in a spreadsheet, but the ability to track them automatically makes everything much easier for a prepared investor, especially when it comes to filing taxes.

With Stock View, dividends and distributions are automatically tracked across your entire portfolio, including dividend reinvestment plans (for Australian and New Zealand investors).

Once you've added all your holdings to Share sight and set up your DRPs, all you need to do is log in to Share sight and review and accept your dividend and distribution payments as they arrive.

Another useful feature for dividend investors: Share sight’s Future Earnings Report (available on the Investor and Expert plans) allows investors to see any upcoming dividends announced. This makes it easier for dividend investors to track monthly dividend income and forecast short-term cash flow.

4. Preparing For Tax Season

For many investors, preparing for tax season can be a nightmare because it requires a combination of paper and digital research. It often extracts from multiple sharing records.

It's called "shoebox syndrome" and it's problematic for accountants and investors alike, with all the back and forth over the various statements and supporting documents needed to file a tax return.

Investors can save time (and potentially money) by tracking all their documents in Share sight throughout the year. Trades and dividends are automatically tracked in Share sight, but investors also have the option to attach files such as trade confirmations and dividend declarations to their portfolio holdings.

This makes it much easier to review these records at tax time before passing the information on to an accountant. Share sight also offers a number of useful reports to help investors. With preparation for tax season:

Taxable Income Report: View all dividends, distributions, and interest payments received during a selected period.

Capital Gains Tax Report: Calculate capital gains from a CGT perspective (for Australian and Canadian investors) during any selected period. Available on Starter, Investor and Expert plans.

Unrealized Capital Gains Tax Report: Calculate unrealized capital gains at any point in time to model capital gain scenarios. Tax loss sales and determination of unrealized CGT. Responsibility. Available on Investor and Specialist plans.

Become A Prepared Investor: Monitor Your Portfolio With Share Sight

If you don't already use Share sight, why not? We are waiting? Join hundreds of thousands of investors who use Share sight to monitor their portfolios and make smarter investment decisions. Sign up today so you can.

Track all your investments in one place, including stocks from over 60 major global markets, mutual funds/managed funds investment, real estate funds and even crypto currencies

Automatically track your dividends and distribution income from stocks, ETFs and mutual funds/managed funds

Create powerful reports for investors, including performance, portfolio diversity, contribution analysis, multi-period and currency valuations, and future returns (upcoming dividends

Easily access your portfolio with your family, your accountant or other financial professionals so they can see the same picture of your investments as you.