This post was first published on capitalmind.in

Last quarter, there were 484 mentions of ROCE in the filings of just the 50 Nifty companies.

ROCE stands for “Return on Wanted Employed.”: how well a visitor is generating profits from its capital. It is considered a hair-trigger part of the puzzle of finding quality businesses.

ROCE typically helps differentiate between ordinary and high-quality businesses.

Imagine we’re looking at two restaurants in the same town, Restaurant A and Restaurant B. Both offer succulent supplies and have a steady stream of customers. How would you identify the largest prospect to invest in?

Restaurant A is a swanky place that spent a lot of money on renovations, high-end kitchen equipment, and a renowned chef. Their supplies is excellent, and they tuition upper prices. However, due to the upper overhead costs, their net income isn’t as upper as you might expect from looking at the price of the dishes on their menu. Their ROCE, which measures how much profit they generate for each dollar of wanted they’ve employed, might not be very high. Despite the upper prices they charge, they’re not turning their wanted into profit as efficiently as they could.

Restaurant B is a increasingly modest establishment. They’ve kept their financing lanugo by leasing cheaper equipment and hiring a less well-known (but still competent) chef. They tuition lower prices, but they serve increasingly customers and their net income is surprisingly high. Their ROCE might be quite good, considering they’re generating a lot of profit for each dollar of wanted they’ve employed. They’re using their wanted increasingly efficiently.

If both restaurants are profitable and have a loyal consumer base, you might think they’re equally good businesses. But as an investor, you’d probably prefer Restaurant B. Why? Considering a upper ROCE indicates that the merchantry is largest at generating profit from its capital. It’s a increasingly efficient merchantry model, and that’s a sign of a high-quality business.

The link between ROC and Returns over the years

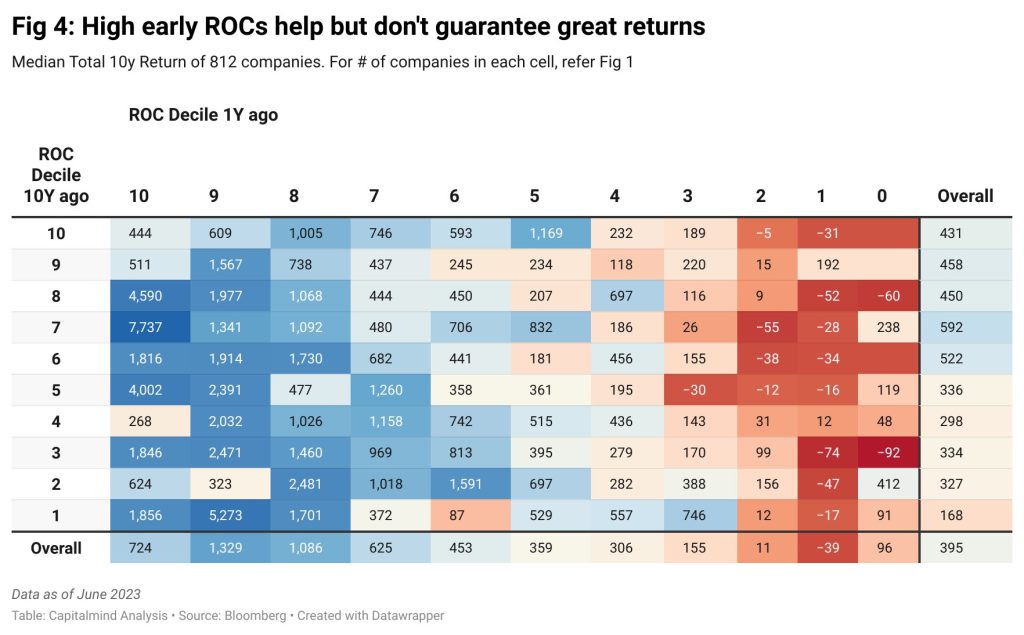

We did a longitudinal wringer spanning ten years centred on classifying companies on the continuum from upper to low ROC and looking at their shareholder returns. The objective was to see what patterns sally that might be considered often winning to the way the stock market rewards shareholders.

We started with over 800 companies that were operational 10 years ago. We classified this cohort into 10 deciles (10 – best, 1 – worst) based on their 3-year stereotype ROCE at that point. By taking a three-year average, we modernize our chances of getting a largest representation of each company’s financial reality than any one year. In addition, we moreover track their three-year stereotype ROC in year T-7, T-4, and T-1, where T is current year.

Then we squint at their total returns over the 10-year period to trammels for any obvious patterns. Whether the upper ROC companies 10 years ago protract to be upper ROC companies today. And to what extent did upper ROC translate to shareholder return?

Here’s what we found.

Return on Wanted is only mildly sticky

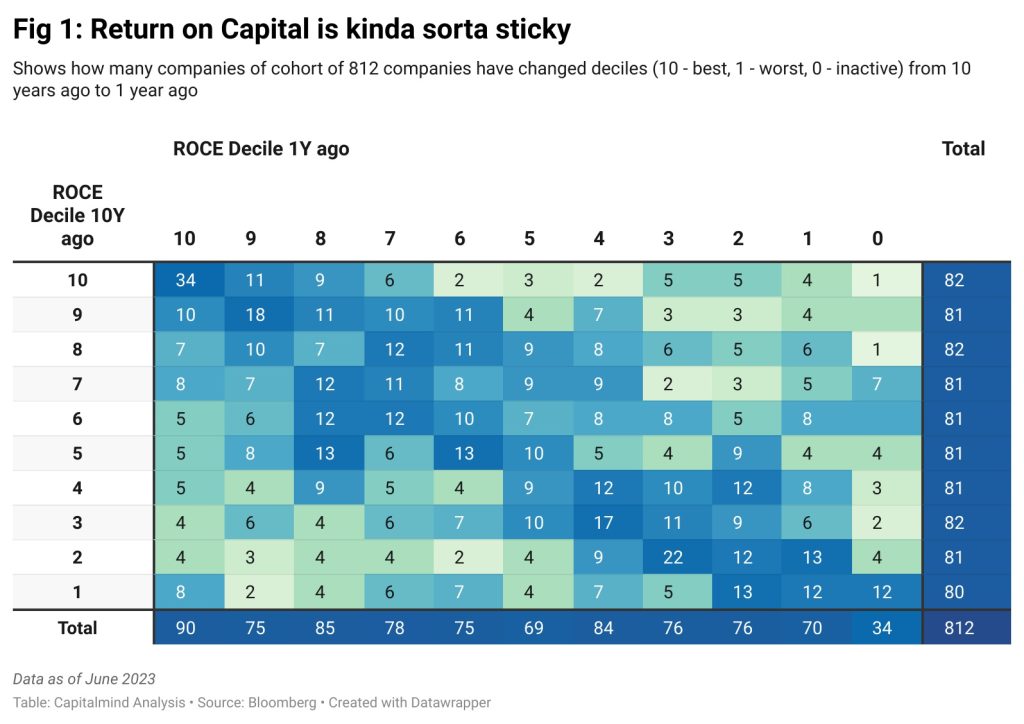

When the 812 companies were split into deciles from 1 (worst) to 10 (best), each decile had well-nigh 81 companies. The table shows how those companies unravel lanugo as of one year ago on the same metric.

Over the last 10 years, those companies either improved their relative decile, got worse, or stayed in the same decile.

Figure 1 unelevated shows that split. The numbers in the table indicate where the companies ended up.

The table should be read row-wise: For example, Top row: Of the 82 companies in the top (10th) decile ten years ago, 34 protract to be in the top decile as of 1 year ago, the remaining 48 slipped to lower deciles – 11 to the 9th decile, 9 to 8th decile, 6 to the 7th decile and so on.

Bottom row (above the total): Of the 80 companies in the marrow decile ten years ago, 8 are now in the top decile, 2 in the 9th decile, 4 in the 8th decile and so on.

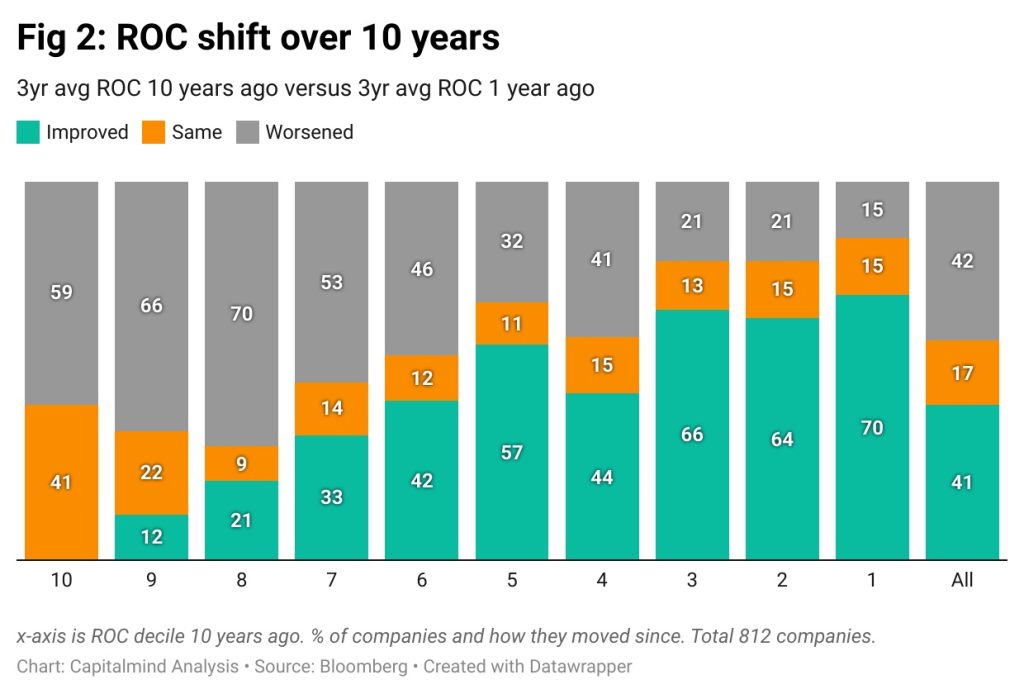

Probably an easier way but with less information is to visualise decile movement from 10 years ago to 1 year ago by percentage of companies.

- 4 out of 10 companies that were top decile 10 years ago were still top decile 1 year ago. This ways 6 out of 10 companies from 10 years ago are no longer top decile. Of course, decile 10 companies had nowhere to modernize to.

- 1 in 4 top-decile ROCE companies a decade ago are now in the marrow half of their cohort of 800 companies

- The highest proportion of companies showing resurgence were in deciles 1, 2 and 3. Put flipside way, the companies at the marrow of the pile showed the most improvement

- 4 in 10 companies wideness the whole set worsened on their ROCE decile, while the same number moreover improved on the same metric

- Not unveiled on this chart: 45% of companies are within 1 or -1 decile of their starting ROC decile a decade ago. The remaining 55% saw larger moves in their relative Return on Capital.

The 34 top-decile companies from a decade ago are still in the top ROC decile

The 34 companies that protract to be top ROC decile

Castrol India ranked #3 on ROC 10 years ago and continues to be in the 10% on the same metric. But squint at its Total Return to shareholders over that period. Glaxo Smithkline improved its Return on Wanted from 10 years ago and shows a cumulative 38% return. This begs the question how constructive is a upper relative return on wanted at predicting future returns.

A glorious past doesn’t necessarily midpoint glorious shareholder returns

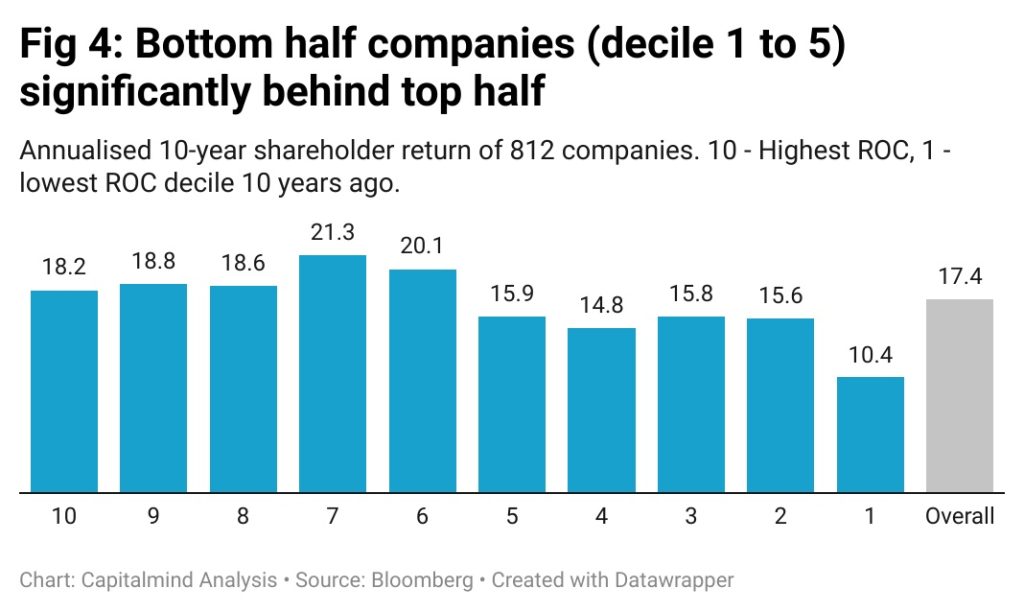

Chart shows median annualised 10-year return from the ten deciles, each with 80 to 82 companies.

Chart shows the volume ten-year return from the companies in the ten deciles. Remember the ROCE considered was the 3-year arithmetic midpoint at the time.

- The right-most post shows the decile-wise 10-year return of the top-to-bottom ROC deciles as of 10 years ago. The marrow decile (decile 1) has the worst 10-year return. The median return from the 7th decile turns out to be the weightier followed by the 6th decile.

- The top ROCE decile of stocks delivered median 431% cumulative total return over ten years. That’s just over 18% annualised

- The highest returns seem to have come from the 7th ROCE decile 10 years ago that were in the top decile recently. Referring when to Fig 1 whilom shows that’s a set of 8 companies. The heatmap shows how the best-returning companies are the ones in the top deciles recently.

- Also, the median stock went up 395%, scrutinizingly 4x over ten years. That is 17.4% annualised. Keep in mind, the cohort of 800 companies includes many small and micro caps at the time which explains the significantly higher return than the Nifty over the same period.

This makes you wonder, how much did consistency of 3yr Return on Wanted stupefy total return?

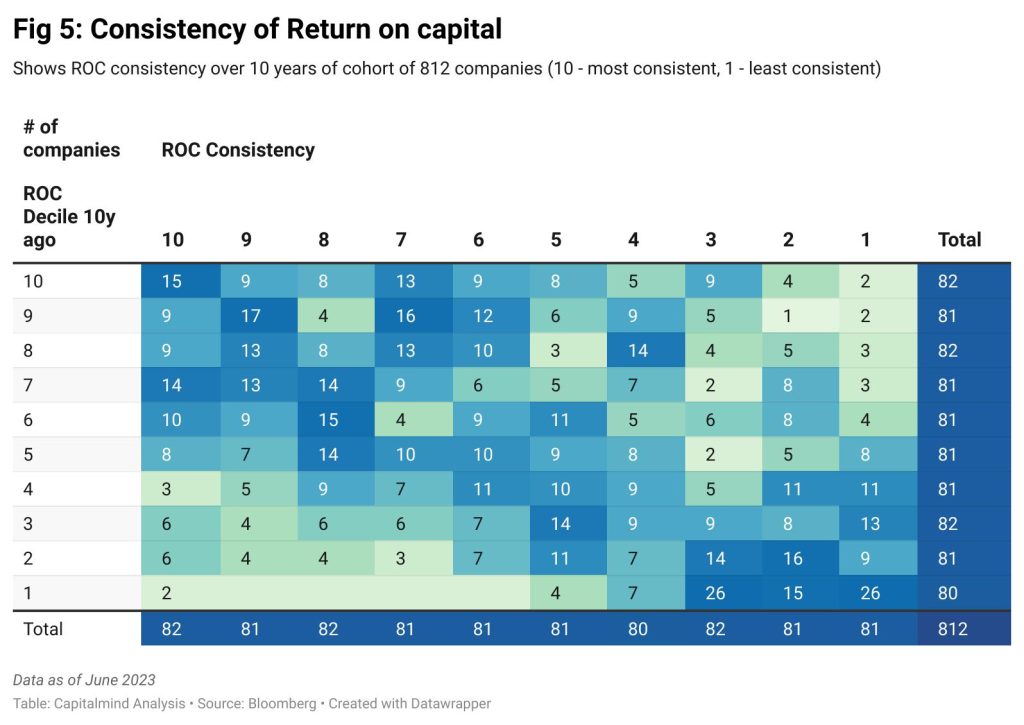

Because Returns on Wanted fluctuate absolutely, not just relatively

The first table considered how much companies shift on relative scale of comparison. This one looks at how resulting companies are on return on wanted with their own past.

We measured consistency as the Standard Deviation of ROCE wideness 10Y, 7Y, 4Y and 1Y ago divided by the Stereotype ROCE over that time frame. This measure is tabbed the Coefficient of variation, which looks to only measure how much a metric reverted over time. Lower the CV, the increasingly resulting the visitor was on its 3-year stereotype ROC over 10 years.

The top decile companies on consistency had the lowest CV (most consistent) while the marrow decile had the highest variation (least consistent).

- The marrow ROC-decile companies 10-years ago were the least resulting since then, which is a probably a good thing for them

- The increasingly resulting companies are in the top few ROC deciles (top left portion of the heatmap), which makes you wonder if they moreover delivered significant return

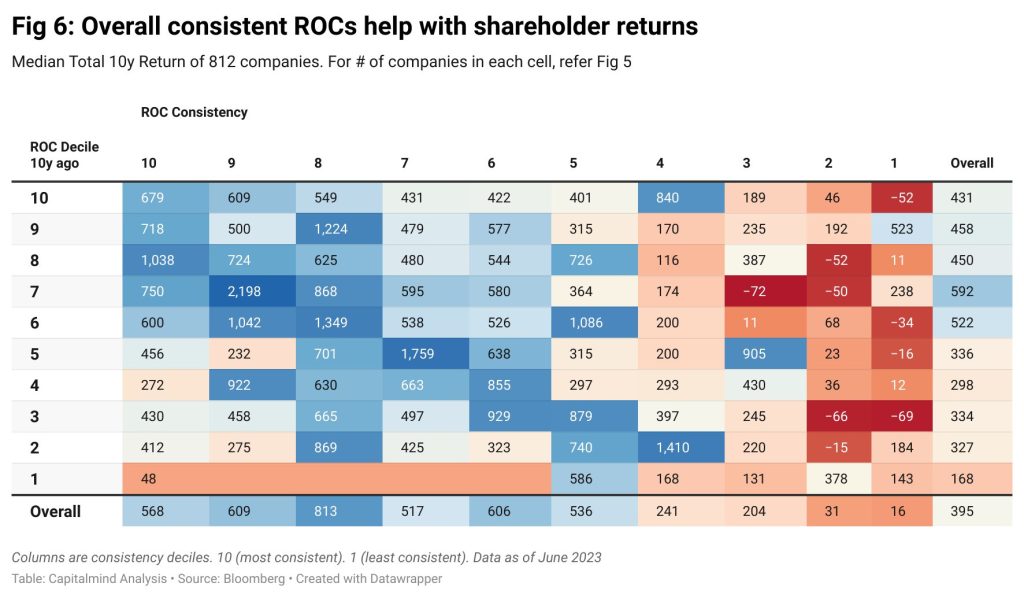

Chart shows consistency decile-wise returns

Chart unelevated maps ROC consistency with starting ROC decile on volume 10-year return.

- The increasingly resulting the return on capital, the largest the long-term returns. The marrow row shows overall returns by consistency; there’s a significant waif as you move from left to right.

- The highest returns came from companies in the top-left quadrant i.e. decent and resulting ROC.

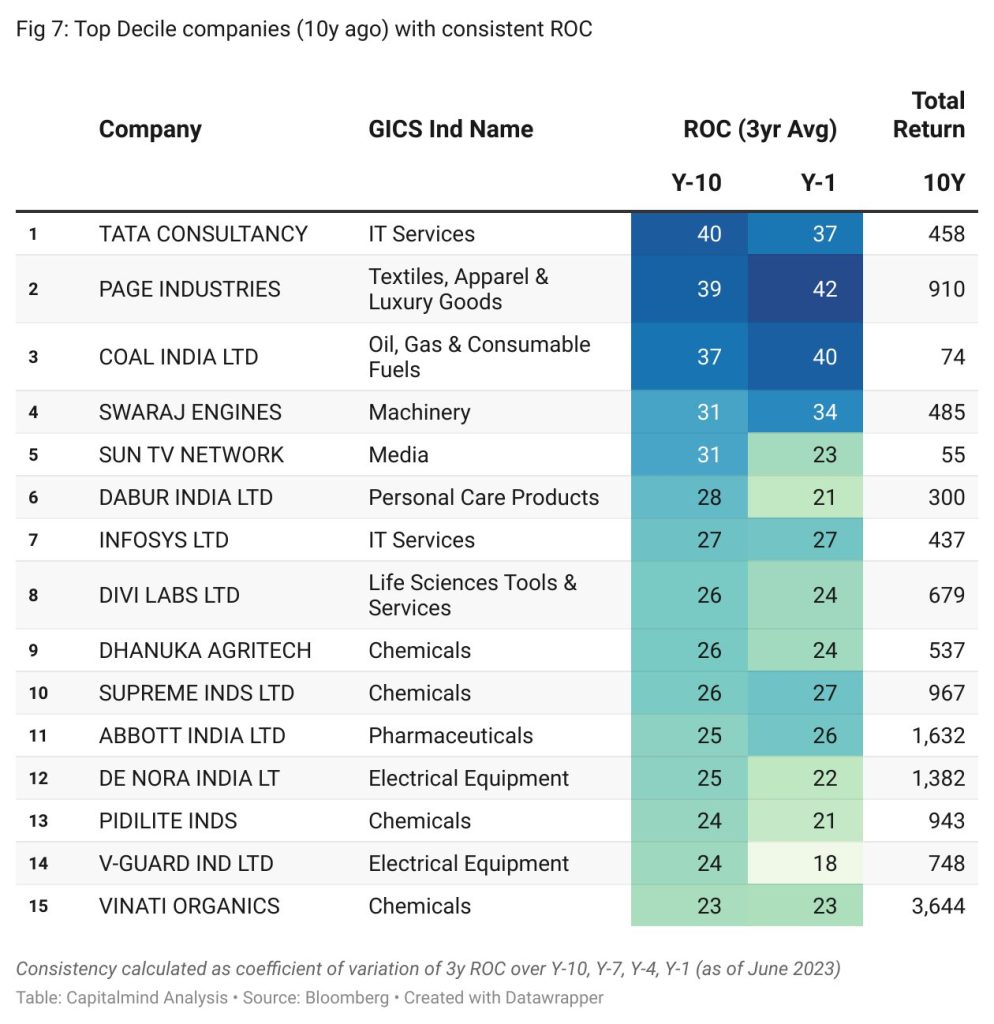

- 15 companies had with highest ROC 10 years ago and were resulting with those healthy ROCs over the last 10 years. They delivered healthy returns but interestingly not the highest returns of their cohort.

So far, the wringer looked at relative ranks of the universe.

But, what if its the trajectory that matters increasingly than where a visitor starts from?

Trajectory of ROC matters (a lot)

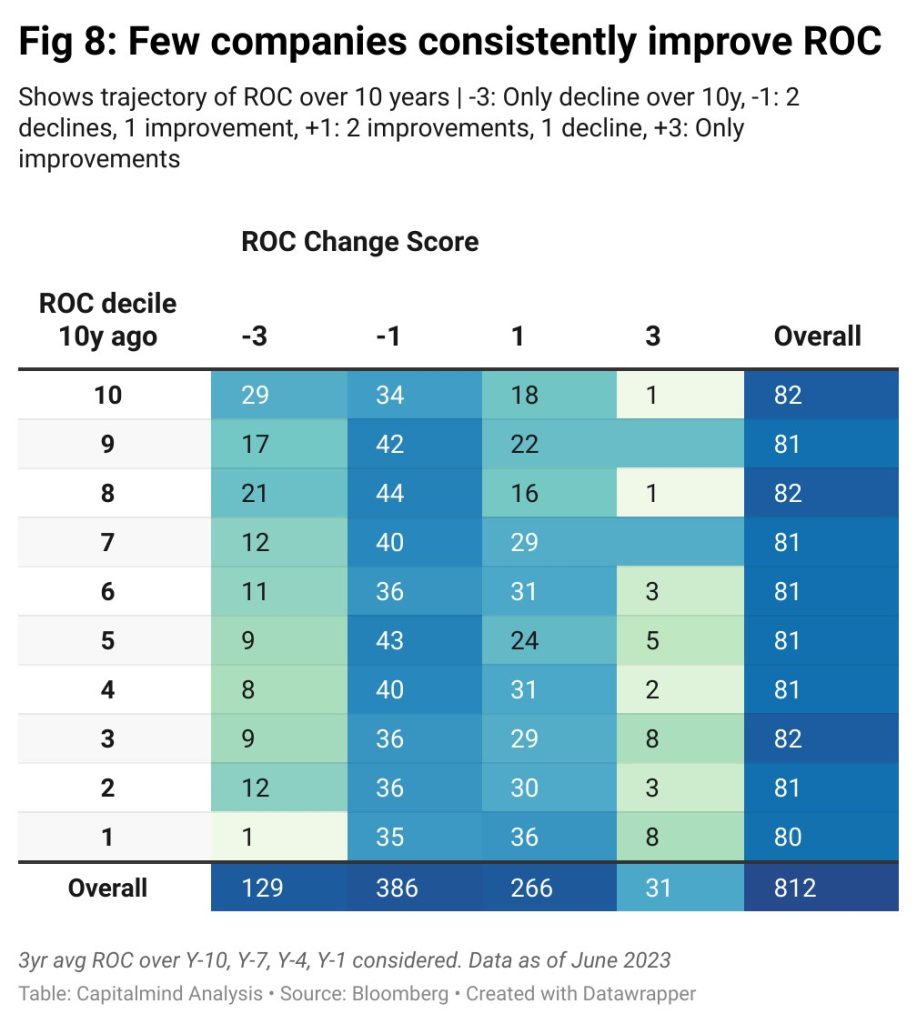

The columns in the table withstand explanation. We had 4 ROCE metrics, T-10, T-7, T-4 and T-1. Each ROCE number is the stereotype ROCE of the last 3 years, which ways the four ROCE metrics imbricate 13 years of yearly ROCE.

The scoring for ROCE trajectory is simple. Starting from the ROCE 10y ago, for each subsequent measurement, the visitor gets 1 if its ROCE improved over the previous and -1 if it worsens. So, any visitor can score maximum 3 i.e. improvements in each subsequent measurement, 1: improvements in 2 measurements and a ripen in one, -1: resurgence in 1 measurement and declines in two measurements or -3: unceasingly worsening ROCE over ten years.

Note how a visitor at a subpar 4% starting ROCE improving to 6%, then 8%, then 11% scores 3, while a visitor at 30% 10 years ago unthriving to 28%, then 26% and then 24% scores -3. We deliberately stayed yonder from increasingly elaborate methods that take the stratum of transpiration into account.

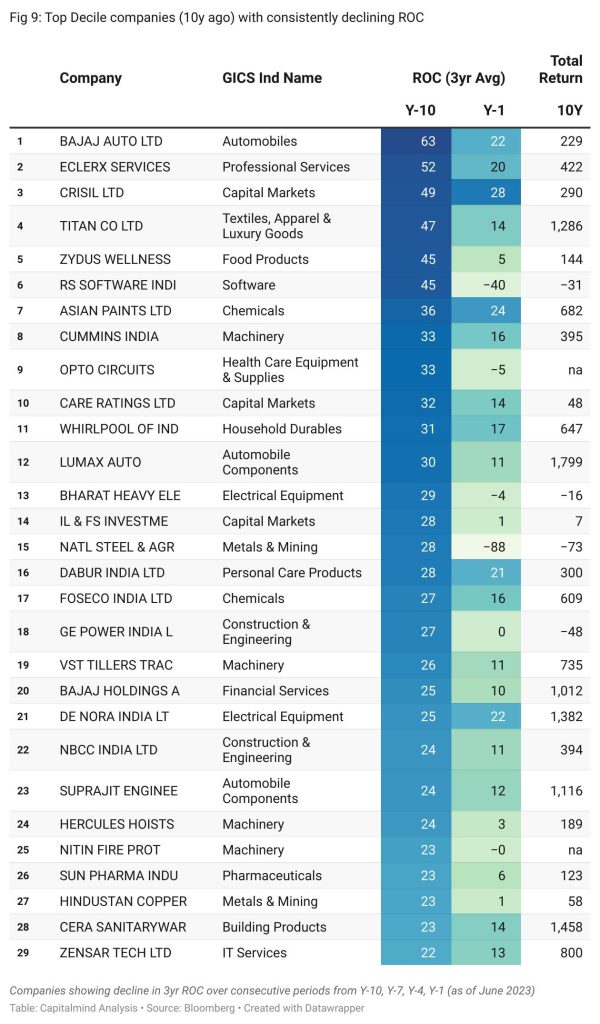

- 16% companies saw unfurled ripen in ROCE over the last 10y. This includes 29 top-decile companies. Unsurprising top-decile names that have seen resulting ripen : BAJAJ-AUTO, BHEL, IL&FS, SUNPHARMA, HINDCOPPER, OPTOCIRCUITS. Some surprising names: TITAN, ASIANPAINTS

- 1 top decile ROCE visitor from 10y ago unfurled to modernize ROCE over the last 10y! P&G

- 30 companies out of 813 unceasingly improved ROCE from 10Y ago. Notable mentions: KPRMILLS, DEEPAKNITRITE, SAREGAMA, INDIANHOTELS, TANLA PLATFORMS

- 80% of companies were the in the middle. Seeing increases and decreases. 48% saw one resurgence and two declines, and 33% saw two improvements and one decline.

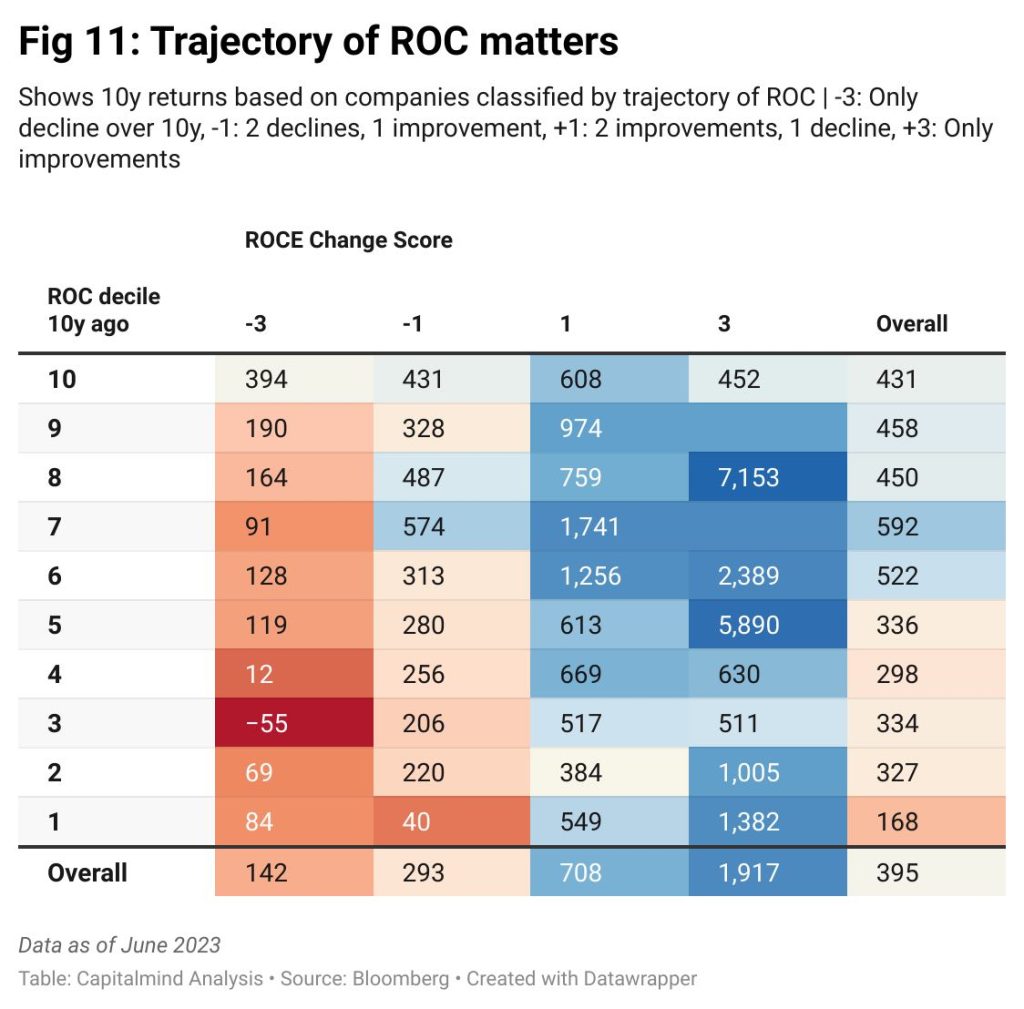

The table now shows the median returns of companies in each category.

- Overall, there is a stark difference between median returns of companies that improved ROCE versus those that did not

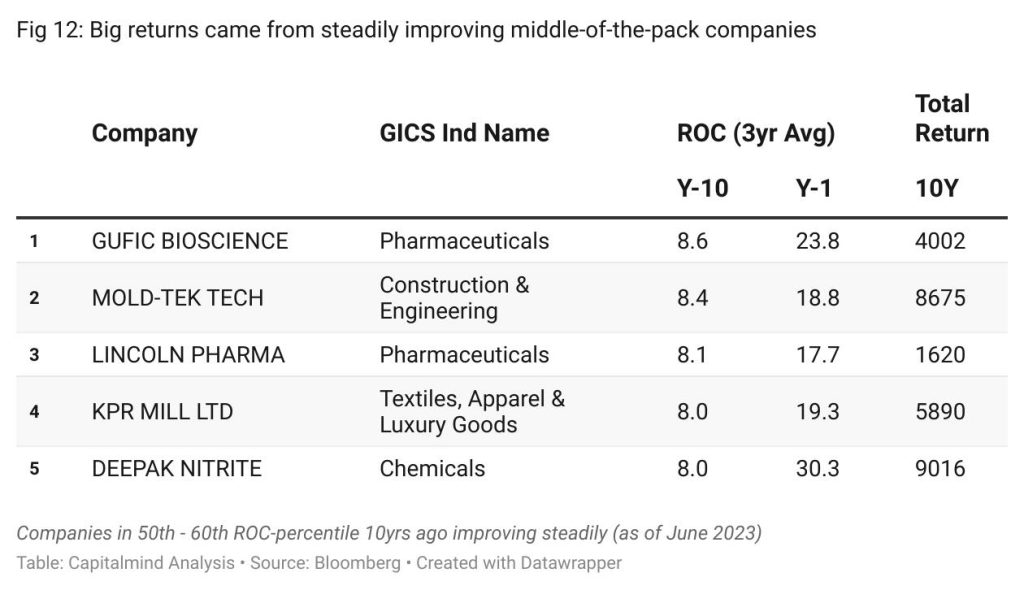

- Highest returns as a group came from 5 companies that were middle of the pack 10y ago: Deepak Nitrite, KPR Mill, Lincoln Pharma, Mold-Tek Tech, Gufic Biosciences. The 7,000% return came solely from Balaji Amines.

- Interestingly, from the top-decile cohort, the highest returns came from the companies that saw 1 ripen over a 3y period and 2 increases. List includes Navin Fluorine, Abbott india, Coforge, JB Chems & Pharma, Havells India, Page Industries. Emami Ltd is surprising in only having gone up 94% in 10Y inspite of what seem to be healthy ROCEs

- The 29 companies top-decile that saw declines in ROCE unsurprisingly did only well-nigh as well as the universe, but not too shabby. Outperformers exist plane in this list: TITAN, LUMAX AUTO, SUPRAJIT ENGG, CERA SANITARYWARE

Conclusion: ROC is necessary but not sufficient

Expecting just one metric to explain returns for a wholesale universe of stocks over 10 years is overly simplistic. Factors like growth and valuations play hair-trigger roles. However Return on Wanted is an important indicator of how thingamabob or non-commodity a merchantry is.

Knowing the high-ROCE companies today doesn’t necessarily tell us where they will be in the future. Common sense tells us that a merchantry earning inordinately upper return on wanted will see others enter the space thus increasing competition and reducing returns for all involved.

The exceptions are those companies that have advantages (moat) that cannot be replicated. Most often we seem to conflate a temporarily upper return on wanted with the presence of a moat that will indulge those returns to continue.

Most companies see their upper returns on wanted erode over time, either considering of increased competition, or an wholesomeness that was short-lived to uncork with. Hence, ROC ranks tend to be fluid.

Then there are the aberrations where the ROC lens does not explain the shareholder returns or lack thereof.

Historically, only a small set of companies (Figure 3) have been worldly-wise to maintain superior ROC over a decent stretch of time. But plane that hasn’t ensured higher shareholder return. Just squint at Castrol.

On the other hand, companies with distinctly ordinary early Returns on wanted have seen strong shareholder returns. The reservation stuff they were worldly-wise to unceasingly modernize their ROC over time signalling an improving business. (Figure 11) Stuff worldly-wise to identify businesses that are currently earning moderate but not non-existent return on their wanted with a roadmap to modernize over time would be the sweet spot of companies most likely to unhook glut return.

Also read:

Where do superhero stocks come from?

This post is for information only and should not be considered to buy or sell any stocks. The objective of the wringer in the post is to get a unstipulated sense of the role Return on Wanted plays in shareholder returns. Do let us know if there any glaring omissions in the way we have looked at the data and how we could modernize the analysis. We’re on twitter @CalmInvestor and @Capitalmind_in.

The post The impact of Return on Wanted on Shareholder Returns appeared first on The Calm Investor.