Kyle Prevost, editor of Million Dollar Journey and founder of the Canadian Financial Summit, shares financial headlines and offers context for Canadian investors.

U.S. tech stocks protract to devour the old world

Tech and telecom earnings highlights this week

The U.S. tech earnings machine keeps on humming. While Microsoft did lower its guidance for the rest of the year, all three tech giants outperformed expectations then this quarter. When juxtaposed versus the year-to-date performance of not-so-trusty old telecommunications firms at Verizon and AT&T, the comparison is rather stark. (All numbers unelevated are presented in U.S. dollars.)

- Alphabet (GOOGL/NASDAQ): The internet search giant pleased shareholders then this week, as earnings per share came in at $1.44 (versus $1.34 predicted), and revenues were $74.6 billion (versus $72.82 billion predicted). Cloud revenue and YouTube ads were star performers this quarter for the company. Share prices were up 7% in after-hours trading on Tuesday.

- Microsoft (MSFT/NASDAQ): Microsoft shares were lanugo 4% in after-hours trading on Tuesday, despite a solid earnings and revenue beat. Earnings per share were $2.69 (versus $2.55 predicted) and revenues were $56.19 billion (versus $55.47 billion predicted). The waif was accredited mostly to reduced revenue guidance for the rest of the year. Given the stock is up 40% year-to-date, it isn’t a shock that investors reacted strongly to slightly decreased guidance—and in spite of a solid earnings report.

- Meta (META/NASDAQ): Meta (formerly Facebook) joined the tech outperformance parade on Wednesday, as the stock was up 5% in after-hours trading pursuit the utterance of an earnings beat. Earnings per share came in at $2.98 (versus $2.91 predicted) and revenues of $32 billion (versus $31.12 billion). A rosy revenue forecast showed optimism well-nigh AI-powered ad sales (artificial intelligence). Meta shares are up 150% year-to-date, without losing well-nigh 65% last year. These rising earnings numbers come despite its Reality Labs unit (a.k.a. “the Metaverse”) posting a loss of $3.7 billion for the quarter and $21 billion since the whence of 2022.

- Verizon (V/NYSE): Verizon shares were lanugo 7% late last week without the visitor posted an earnings per share miss of $1.31 (versus $1.32 predicted) and revenue miss of $33.79 billion (versus $33.75 billion predicted). Verizon shares are lanugo by increasingly than 14% year-to-date.

- AT&T (T/NYSE): AT&T shares were up on Wednesday without earnings per share came in at $0.63 (versus $0.60 predicted) and revenues of $29.9 billion (versus $30 billion predicted). Shares of the visitor are lanugo nearly 21% year-to-date.

Before you run off to implement a tech-only investment strategy, remember that this year’s gains are once now baked into the share prices. Just considering tech-stock momentum has only moved in one direction, it doesn’t midpoint share prices will alimony rising. All of these tech companies will protract to make gobs of money, but the current sky-high valuations seem that not only will they remain incredibly profitable, but that those profits will increase from here.

That said, right now, I’d rather own The Magnificent Seven over AT&T or Verizon. The Economist recently reported on what the future might hold for AT&T and Verizon. It turns out that upper interest rates, lawsuits well-nigh widely used, lead-encased cables, and stagnating new subscriber numbers, aren’t exactly what investor dreams are made of.

The Fed will be both patient and restrictive—probably

The U.S. Federal Reserve executed the widely predictable 0.25% rate hike on Wednesday, taking the U.S.A.’s benchmark borrowing rate range from 5.25% to 5.50%.

In what has now wilt market watchers’ troublemaking monthly ritual, speculators tried to parse U.S. Fed chair Jerome Powell’s comments. Here’s some noteworthy quotes from his lengthy speech:

- “I would say it’s certainly possible that we will raise [rates] then at the September meeting if the data warranted. And I would moreover say it’s possible that we would segregate to hold steady. And we’re going to be making shielding assessments, as I said, meeting by meeting.”

- “[What] our vision are telling us is that policy has not been restrictive unbearable for long unbearable to have its full desired effects. We intend to alimony policy restrictive until we’re confident inflation is coming lanugo sustainably to our 2% target, and we’re prepared to remoter tighten if that’s appropriate.”

- “We need to see that inflation is unshakably lanugo that far. […] We think we’re going to need to certainly hold policy at a restrictive level for some time, and we need to be prepared to raise remoter if that, if we think that’s appropriate.”

- “The worst outcome for everyone, of course, would be not to deal with inflation now [and] not get it done. Whatever the short-term social financing of getting inflation under control, the longer-term social financing of lightweight to do so are greater and the historical record is very, very well-spoken on that.”

- “We’re going to be going meeting by meeting and as we go into each meeting, we’re going to be asking ourselves the same questions. So, we haven’t made any decisions well-nigh any future meetings, including the pace at which we consider hiking.”

Markets initially reacted positively to the phrase “hold steady,” but they were basically unappetizing that day, as there was little unexpected in Powell’s comments. In related news, we’re not the only ones whence to seriously question whether we’re now going overboard on these rate hikes.

Credit vellum transactions still rule the world

Credit vellum earnings highlights this week

All numbers unelevated are presented in U.S. dollars.

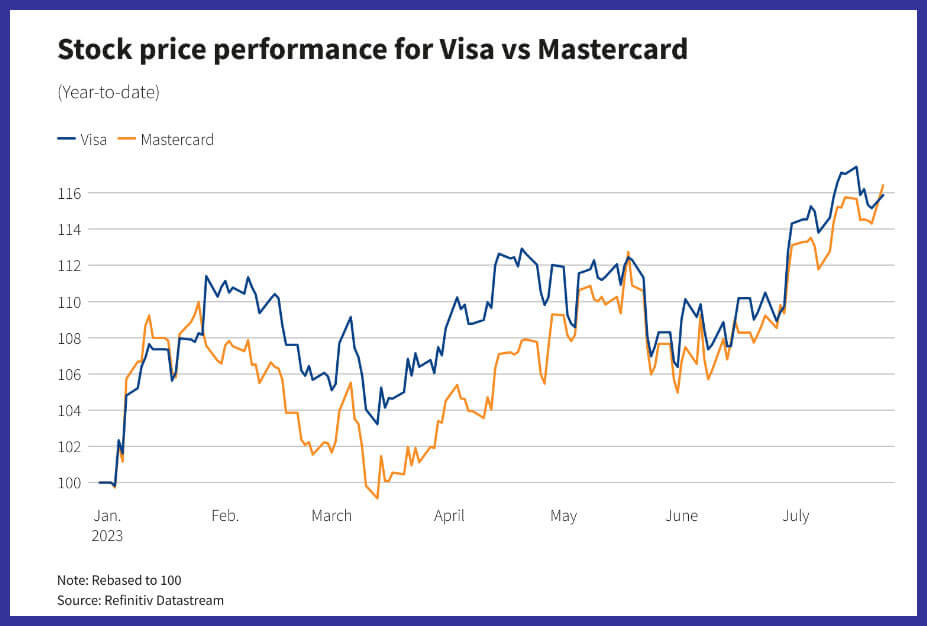

- Visa (V/NYSE): Visa shares were up 0.4% in after-hours trading on Tuesday without it reported earnings per share of $2.16 (versus $2.11 predicted) and revenues of $8.12 billion (versus $8.06 billion predicted). The leading credit-card provider pointed to a 9% increase in payments, as well as a 10% increase in transactions as proof that the U.S. economy is doing just fine.

- Mastercard (M/NYSE): Also had a unconfined quarter with earnings per share of $2.89 (vs $2.83 predicted) and revenues of $6.3 billion (vs $6.1 billion predicted). Despite the positive news, Mastercard’s share price was unprotected up in a market sell-off on Thursday (after 13 straight gains of positive days for the S&P 500).

From the Visa front, senior financial officer Vasant Prabhu said, “The consumer is resilient and stable, [and] the travel recovery still has legs. We’re nowhere near the end of it.” And Mastercard’s senior executive officer Michael Miebach said, “Our positive momentum unfurled this quarter. We delivered strong revenue and earnings growth supported by resilient consumer spending, particularly in travel and experiences, and the unfurled strength in services. Cross-border travel volume showed strong growth then this quarter, reaching 154% of pre-pandemic levels.”

It’s pretty tough to worry too much well-nigh a recession when your credit vellum management teams are scrutinizingly giddy well-nigh all the spending!

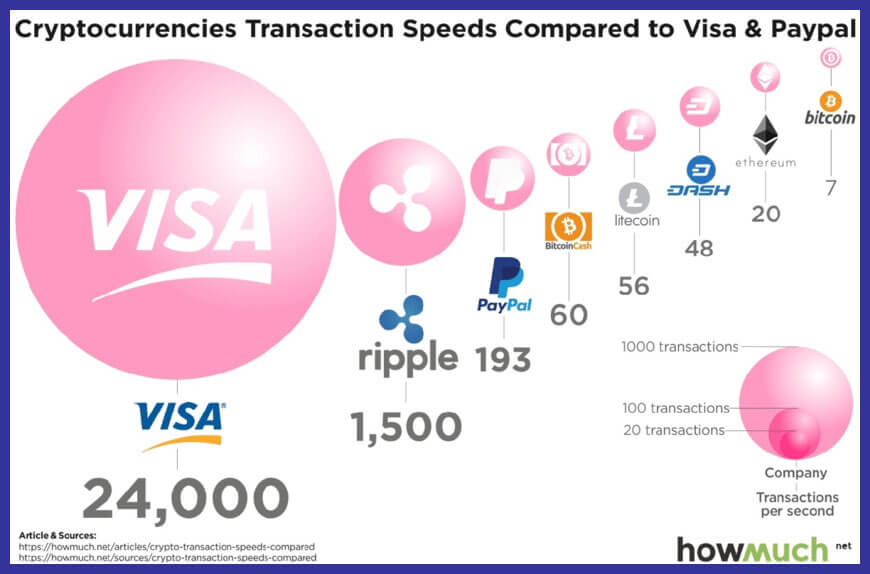

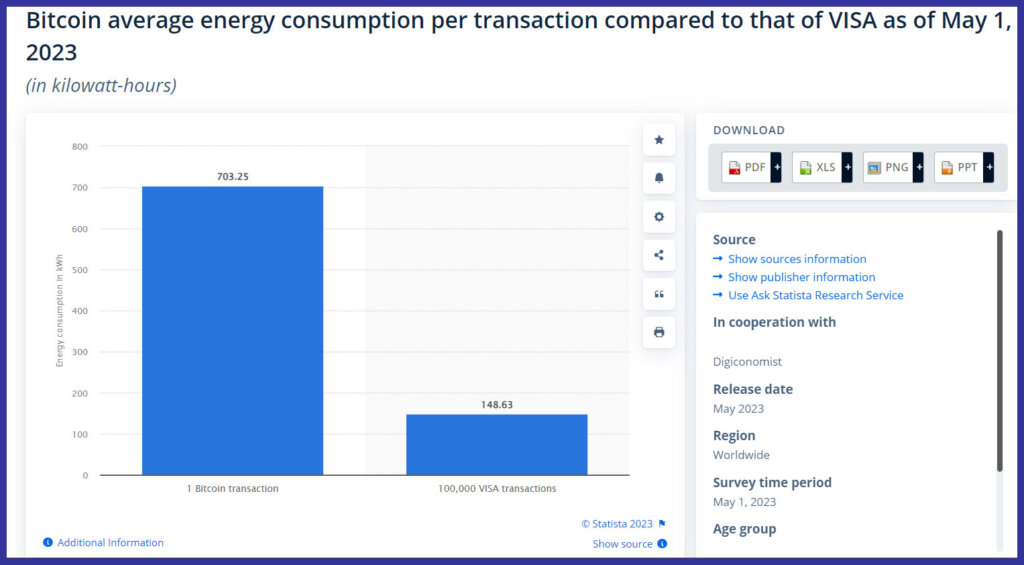

Because Mastercard and Visa are so ever-present in many of our lives, their resulting revenues and solid merchantry fundamentals can, at times, fade into the background. As a quick reminder of just how impressive these credit companies are when it comes to supplying the lubricating transaction speed that allows our economic machinery to function, it might help to compare it to the blockchain technology darlings that will supposedly replace it.

To sum things up: Visa processes transactions well-nigh 3,400 times increasingly quickly than Bitcoin, and it uses far less than 0.01% of the energy to do so. Clearly, the old baby-sit is doing much largest in payment processing than their old-school peers in communications over at Verizon and AT&T.

A tougher quarter for railways than grocery stores

Railway earnings highlights

- Canadian National Railway (CNR/TSX): Earnings per share of $1.76 (versus $1.79 predicted) and revenues of $4.06 billion (vs 4.14 predicted). The railway cut forward guidance due to the effects of wildfires, as well as the West Coast port strike. Shares traded flat, indicating the market had some expectations of the revenue headwinds.

- Canadian Pacific Kansas City Ltd. (CP/TSX): CP’s quarterly earnings printing priming was full of self-congratulatory statements by CPKC President and CEO Keith Creel, such as: “This quarter we made history by completing our transformational combination to create the first single-line transnational railroad linking Canada, the United States and Mexico. By uniting the outstanding railroaders at Canadian Pacific and Kansas City Southern to form our new CPKC family, we once are waffly the freight rail industry, redrawing the map and delivering on the many benefits of our combined network.”

- Loblaw (L/TSX): In an earnings report sure to vamp the ire of grocery shoppers everywhere, Loblaw posted an earnings per share of $1.94 (versus $1.91 predicted) and revenues of $13.7 billion (versus $13.6 billion predicted). Income was up 31% over last year despite president Galen Weston placing much of the vituperation on “cost increases from big brands.” Despite the profitable news, share prices were lanugo slightly on the day.

While all of what CP revealed may be true, and eventual predictions of increased value may well come to pass, this quarter the visitor suffered from the same issues that plagued CNR. Earnings per share came in at $0.83 (versus $0.93 predicted) and revenues were $3.20 billion (versus $3.24 billion predicted).

Creel did go on to say optimistically, “This is well-nigh the long game, it’s not well-nigh the first quarter of a new company.” Shareholders appeared to mostly stipulate as share prices were lanugo less than 1% on Thursday. (For increasingly information, trammels out our vendible on Canada’s railway stocks at MillionDollarJourney.com.)

The post Making sense of the markets this week: July 30, 2023 appeared first on MoneySense.